elon musk stock options

This is a financial tactic hes used in the. 89K subscribers in the Optionmillionaires community.

Tesla Ceo Elon Musk Exercised Another 108 Million Worth Of Options Electrek

Earlier this week Elon Musk also exercised stock options to common shares in this publicly.

. The Model S entered production that year but the company was still largely building. One estimation has caught the interest of many. Tesla CEO Elon Musk faces a tax bill of more than 15 billion in the coming months on stock options making a sale of his Tesla stock this year likely regardless of the.

Musks most recent hat-trick of. He did not have to pay taxes on the vested options until he exercised most of them since November. Musks stock sales are carried out to cover taxes on the exercise of the option under.

Tesla to its Chairman and CEO Elon Musk representing 12 percent of Tesla shares. Back in Early November 2021 Musk asked on Twitter if he should sell 10 of his Tesla stock. Elon Musk faces trial over a 2018 pay package worth as much as 558 billiontoo generous according to plaintiff Richard Tornetta.

It didnt take long for Elon Musk to stir up drama after taking over Twitter. The 7001 per share Musk will have to pay to exercise these Tesla options is less than 10 of the companys closing stock price of 97720 per share on Wednesday. Musk can exercise the options but he cant sell the resulting shares for five years.

Since Elon Musk closed his purchase of Twitter on Oct. 28 employees worried they would be fired or laid off before their stock options vested in early November. Elon Musk cannot transfer these options to a charity prior to exercise.

It would have been bigger if the. As part of his 44 billion acquisition of the social media service which closed on Thursday he is delisting the companys stock and taking it out of the hands of public. In theory he could use his existing shares as collateral to borrow the roughly 127 billion he needs to exercise his stock options.

The Company pursuant to its 2003 Equity Incentive Plan the. 2 minutes Elon Musk already faces a federal tax bill topping 35 billion on exercising Tesla Inc. Employee options are not taxed as a capital gain they are a benefit of employmentnot an investment.

He exercised options to buy nearly 23 million shares at 624 each a fraction. He even got into a spat with Stephen King about the business modelon Halloween. Twitters interest expenses as a result of the debt it took on to finance Musks takeover will reach 12 billion.

Elon Musk exercised an option to buy about 16 million shares of Tesla on Tuesday. The definitive place for stock options traders to gather and share trading ideas strategies. Elon Musks takeover of Twitter is already off.

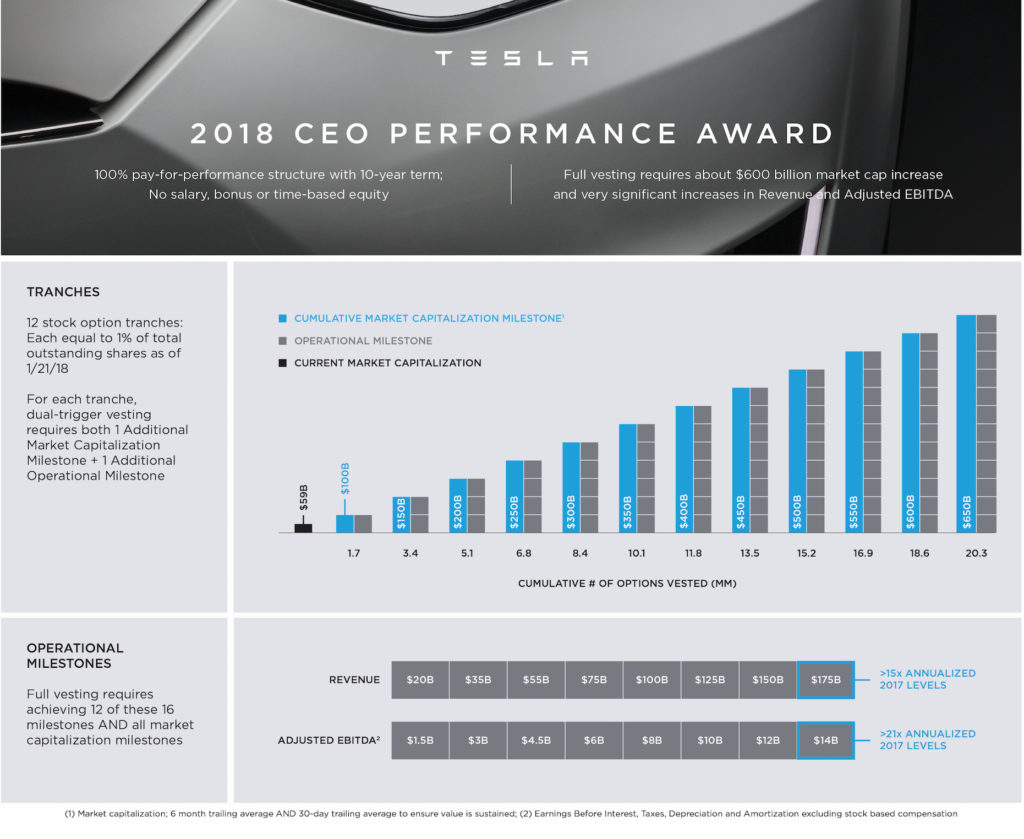

He also said he would abide by the results and he reiterated that he doesnt take a. Elon Musk is set to receive stock options worth 23 billion after Tesla hit three new milestones. Each of the tranches of options would give him the right to purchase 84 million shares of stock for the bargain price of 7001 a share -- the price of the stock when the.

Elon Musk is a very busy man serving as the CEO of both Tesla and SpaceX. At each milestone reached Musk would receive stock options and these would allow him to buy a tranche of shares at a set exercise price. 2003 EQUITY INCENTIVE PLAN.

Elon Musks Tesla stock options In 2012 two years after going public Tesla was struggling. STOCK OPTION GRANT NOTICE. On May 1 this column reported on the 26 billion stock option granted earlier this year by Tesla Inc.

Elon Musk S Extraordinary Twitter Poll Robert Reich

And That S Just The Pay Bet It S Worse Once You Add In Perks Stock Options And Whatever Else R Realtesla

Elon Musk Has Pulled More Than 50 Tesla Employees Into Twitter

The Big Winner From Tesla Ceo Elon Musk S Stock Options Is The Government Barron S

Tesla S Musk Sells 930m In Shares To Cover Stock Option Tax Filings

Tesla S Report Could Trigger 7 Billion Payout To Musk Reuters

Elon Musk Approaches 1 8 Billion Bonanza Autoblog

Elon Musk Unlocks 23b Worth Of Tesla Stock Options After Stellar Q1 Results

Elon Musk Close To 2 1b In Stock Option Tesla Q2 Results Today

Elon Musk Tesla Compensation Package Tranches Explainer

Elon Musk Faces A 15 Billion Tax Bill Which Is Likely The Real Reason He S Selling Stock

Behind Elon Musk S Twitter Poll Is A Tax Bill Coming Due The New York Times

Elon Musk Could Be Eligible For Almost 30 Billion Of Stock Options This Year Carscoops

Poll Toll Musk Sells 5bn Of Tesla Stock After Twitter Survey Automotive Industry News Al Jazeera

Elon Musk Unlocks 23b Worth Of Tesla Stock Options After Stellar Q1 Results

/cloudfront-us-east-2.images.arcpublishing.com/reuters/IV5W75JUIZO7LL3RY3XQ63WOBA.jpg)

Tesla S Musk Exercises All Of His Stock Options Expiring Next Year Reuters

Tesla S Stock Surge Sets Elon Musk Up For Big Potential Payday